It is a truth universally acknowledged that, if you don’t reach your audience with your messages, they won’t buy your product or service. This is a fundamental truth for any brand seeking to create immediate sales and revenue from those prospects currently in market. If you don’t reach those audiences, you leave them vulnerable to be snatched up by competitors.

Any changes to how consumers, or various segments of the population, spend their time with different channels are immediately significant for those of us who seek to maximise sales each and every day. So, this week we greeted the release of the first tranche of IPA Touchpoints 2021 data with interest. We are huge fans of this dataset, which allows us to track the location, mood, behaviours, and media consumption across all channels and devices of UK adults. It is the most effective lens into daily behaviours and changes to them over time. This year, Touchpoints is fifteen years old, but we were more interested in recent history, specifically comparing media consumption pre-pandemic with that in Lockdown 1.0. Then again in January-March this year, during lockdown 3.0.

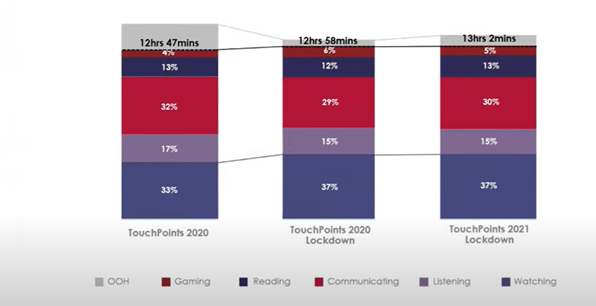

We started by asking how long UK adults are spending with media channels each day, and figure one shows the first answer below. However, before looking at it closely, a word of warning: The minutes spent in total per day have been adjusted down to exclude Out of Home media time. That’s because pre-pandemic, the average adult spent 6 hours 22 minutes awake and out and about. This fell to just 2 hours and 42 minutes this spring.

All adults 15+: Daily minutes with media-Pre pandemic vs Lockdown one vs Spring 2021

Source: IPA Touchpoints

In short, we are spending more time watching; less time listening and communicating; about the same time reading, and more time gaming than back in the day. The changes don’t seem dramatic at first glance, but under the surface are three big trends that could impact the effectiveness of your advertising this summer.

1. The Reach that channels deliver is changing

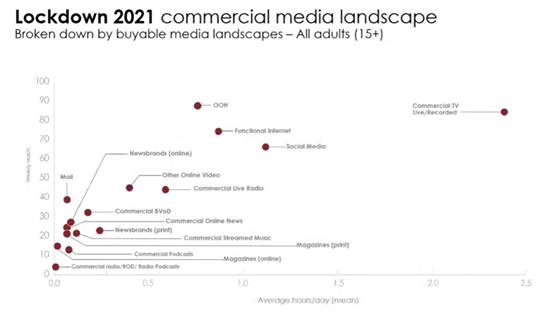

For most clients, the vast majority of media investments will be in Paid media (that’s advertising or sponsorship opportunities). But unfortunately, these only exist on commercial media channels – the BBC, and increasingly SVOD channels like Netflix and Disney+ don’t accept advertising. So, we asked the question, not how do adults spend their time with media, but how do they spend their time with commercial media, where we can advertise.

This time, the data is arranged in a slightly different way. The vertical axis shows the weekly reach of a commercial channel, i.e., what percentage of all adults use that media in a typical week. The horizontal axis shows the dwell time with the channel – the average number of hours we spend with it on a typical day.

Figure two: Weekly reach and dwell time for commercial media channels- Spring 2021

Source: IPA Touchpoints 2021

Source: IPA Touchpoints 2021

If we’re trying to reach our audiences, then there are four giants, each of which deliver the eyeballs of more than 65% of us each week. TV, Out of Home (even in lockdown!), “functional” internet (think search), and Social media.

Radio, YouTube, Mail, and BVOD can each generate 30% reach. Everything else is smaller. But again, a caveat: The data above is for all adults. We have written before about the growing generation gap in media consumption, and it is continuing to grow in Q1 2021.

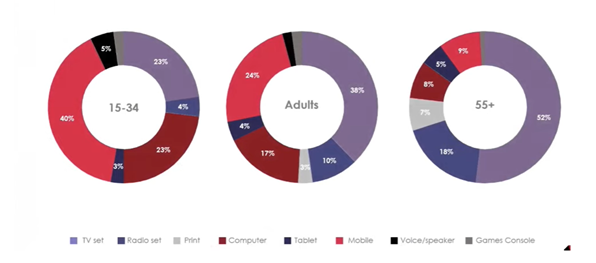

2. The Reach that different devices deliver is changing

Figure three, below, shows a comparison between the time spent each day on different devices for the under 34’s, the over 55’s, and the average “all adults” – in the middle. The first thing to take from this is screen size: The old spend 52% of their media day in front of a big screen – the TV; For the young, the figure is less than half that at just 23%. They spend 40% of their day on a small screen- their mobiles. For the older group, this is just 9% of their day. There is a creative imperative here, at the very least. Even if the young do watch commercials (and they do), a large proportion of their consumption is in the vertical, not horizontal, axis, and your ads are smaller than you designed them to be.

Figure three: The old and the young use different devices to consume media

Source: IPA Touchpoints 2021

Listening time and devices are radically different too. Many years ago, commercial radio stations delivered a young audience, but fast forward to 2021 and while over 55’s are listening to 144 minutes of commercial radio each day, under 34’s are tuning in for just 28 minutes (that’s one fifth of the time the old spend with radio). The young do listen, but to do via streaming services and for around 50 minutes each day, some ten times longer than the over 55’s, which brings us to our last trend…

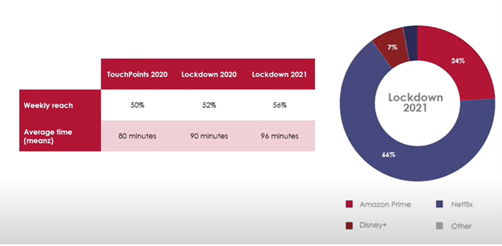

3. The Reach that streaming vs live services deliver is changing

The success of subscription services in the last year has been much commented on. Disney+ chose the best day ever to launch as Boris told us all to stay at home. Figure four, below, shows how now 56% of us watch an SVOD channel, and we spend 20% longer with them each day. Netflix continues to dominate this terrain, but watch Amazon continue to grow this year.

Figure four: More of us are spending longer with Subscription video on Demand channels

Source: Touchpoints 2021

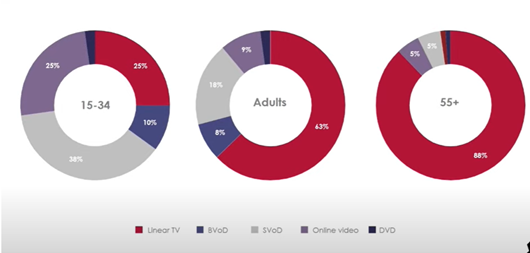

The implication for advertisers can be seen in our final chart- figure five.

Figure five: share of “watching time” by young and old- spring 2021

Source: Touchpoints 2021

If you want to reach the over 55’s with an audio-visual ad, then stick to old fashioned linear TV. If you need to reach the under 35’s, then the schedule will have to be supplemented with Broadcaster video on demand and online video from Facebook and others.

What are the implications for advertisers this summer?

Like the trends above, the implications are three-fold. Firstly (and this applies to all clients seeking to reach a range of age groups), think about your creative assets – not just the messages that might be relevant to different age groups, but also the formats. Consider creating different versions of the same message for different devices, i.e., a radio ad might benefit from different versions for live vs. streaming, or a TV ad shown on a big box vs. one on a mobile screen definitely will.

Secondly, if you are at the point of diminishing returns from reaching new eyeballs with your media mix and you have limited resources, consider adding devices rather than new channels. Adding print magazines to a linear TV and digital media schedule will ensure you reach another 5% of adults. Adding broadcaster VOD would reach three times more consumers and wouldn’t require a new creative treatment.

Finally, if you have a small budget, say less than £50,000 per month, don’t worry too much about this. Or, if you are trying to build frequency to build consideration or understanding of a specific brand attribute, this may be less relevant.

Please get in touch for further advice on device vs channel mix or support on cost-effective versioning of your assets for different platforms.