The Christmas count down is looking very different for us all this year, but perhaps facing the biggest challenge in this behavioural shift is the retail sector and more specifically, the high street stalwarts who have had to adapt and quickly, if they are to survive the cold winter of 2020.

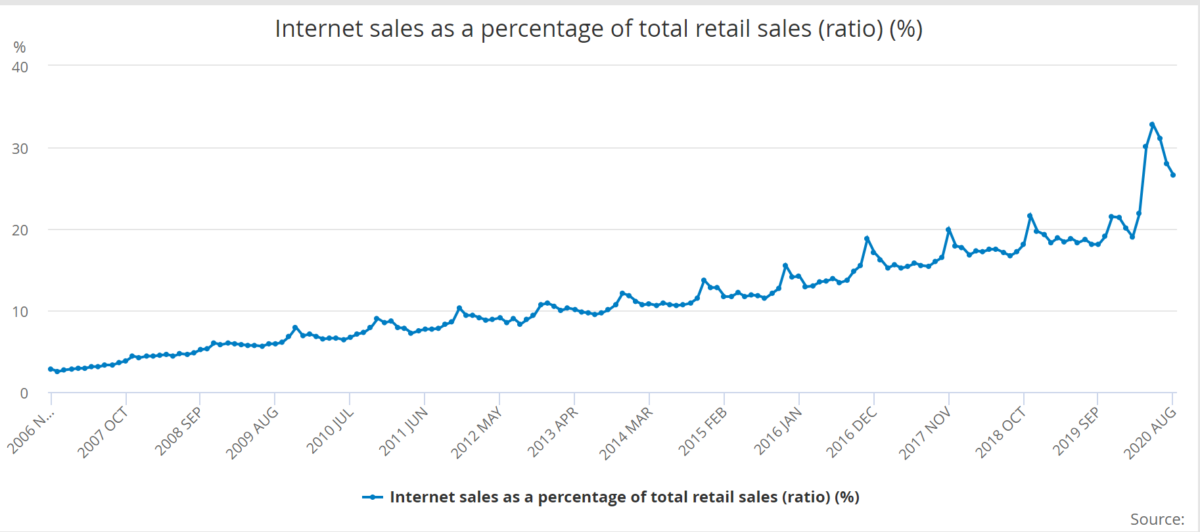

The chart below shows ONS data tracking online sales as a % of total retail sales from 2006 until August 2020. Internet sales peaked at 32.8% of all retail in May this year and was gently declining into the high 20%’s in August. Local and devolved national lockdowns will mean that the internet share will spike again this autumn, probably back to somewhere near 70% growth year on year.

Source: ONS Internet sales as % of total retail sales 18th September 2020

This picture is reinforced by recent data from the British Retail Consortium and KPMG. Total retail sales for the five weeks ending 3rd October grew by 5.6% year on year, but in store non food sales declined by 12.3% during the same period. Consumers are still spending, but much less than in the past on the high street.

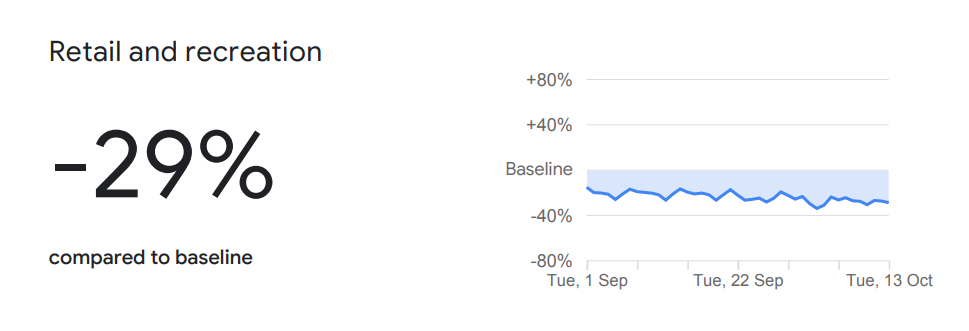

Google mobility data for the six weeks ending 13th October shows the same picture of migration away from IRL shopping. The chart below shows that footfall in shopping centres, restaurants, and other high street locations is some 29% below the baseline set back in January/February this year.

Source: Google mobility data UK 6 weeks ending 13.10.20

All of the above has had an unforeseen consequence on the marketing efficiency of UK retailers. Until March of this year, your average high street retailer had benefited from ‘invisible’ advertising in the form of point of sale impressions and those twinkling window displays. To put this into perspective, we’re going to use TM Lewin, now an online only menswear retailer, as an example.

Back in 2019, when TM Lewin had physical high street stores, they generated more than 500,000,000 ‘free’ OOH impressions from their footfall and passing traffic. That means that roughly 70% of us in their catchment area would have seen an ‘ad’ from them every two weeks or so. That’s quite a lot of free advertising if you are a high street retailer.

Fast forward to Christmas 2020, and many retailers will have shifted, if not totally (as TM Lewin have), then dramatically online, meaning they will miss out on previously achieved reach and frequency from lack of store traffic. If they hope to replace high street revenues with online revenues, they’ll have to replace their lost advertising impressions, and will likely to turn to TV.

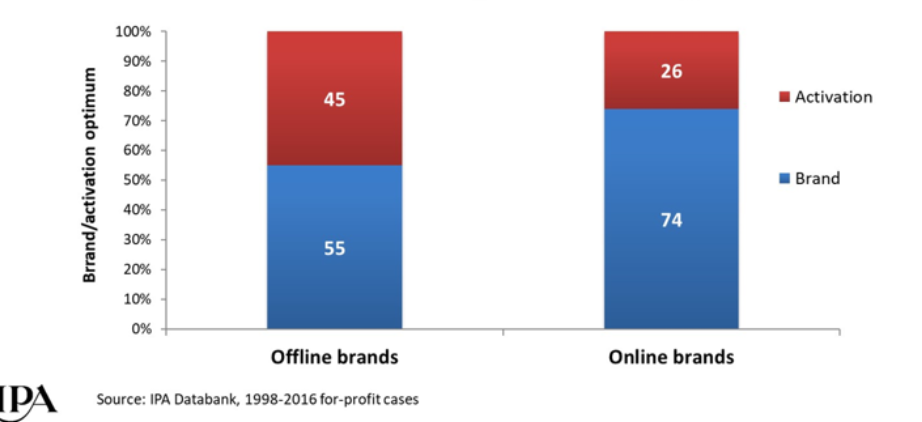

An 18 year longitudinal study of the IPA effectiveness databank (to which we have proudly contributed with a number of effectiveness award winners) found that online brands are less visible than real-world brands, and thus need a greater proportion of brand to activation spend, as the chart below shows.

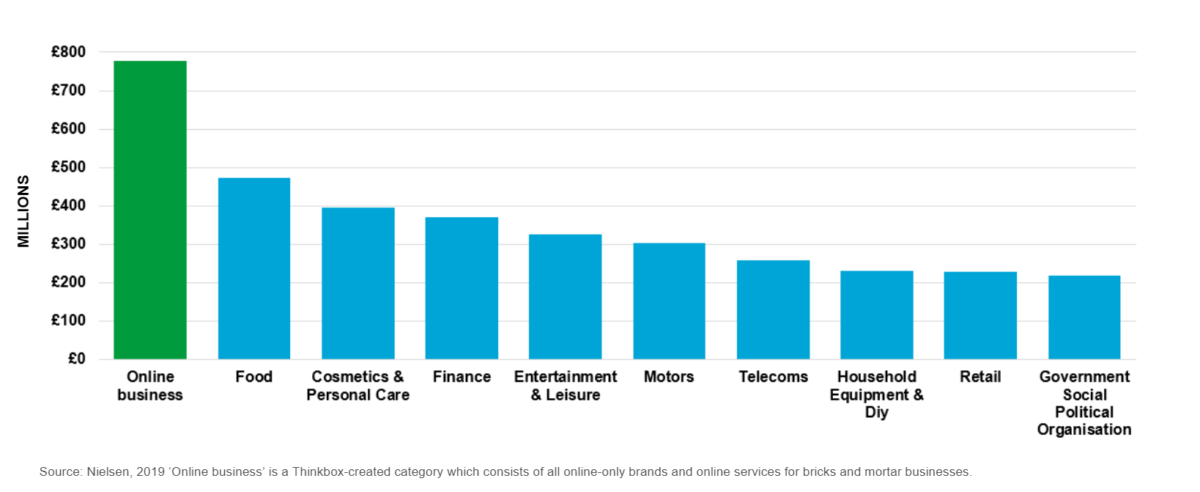

The most effective brand building medium (and now the fastest reach builder and best dwell time generator) is TV. So, it’s not surprising that in 2019, Thinkbox found that ‘online businesses’ were the single biggest sector of revenue for TV.

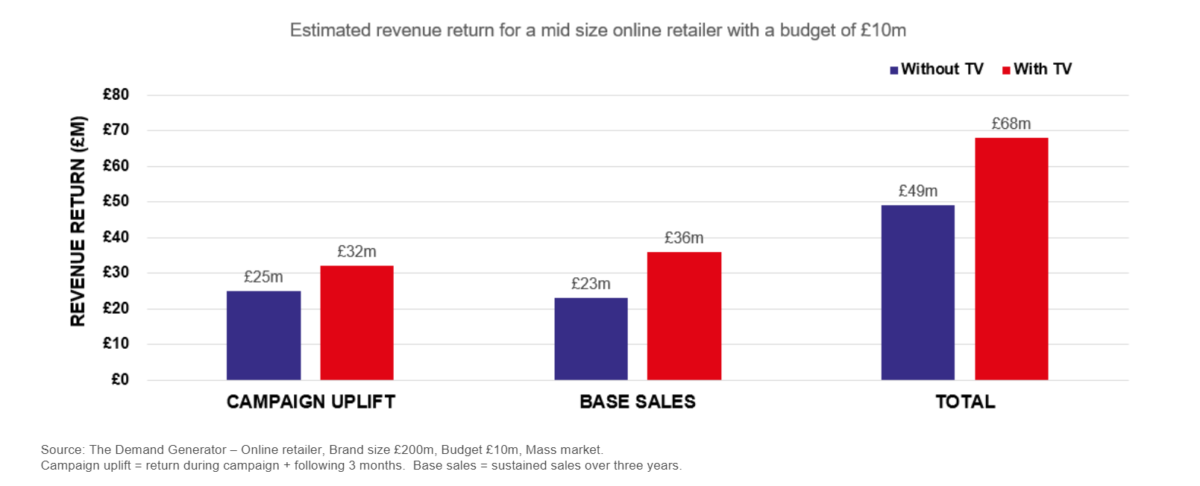

ThinkBox explain this dedication to TV by both the immediate and longer term returns that can be generated, as per the example below. Their calculations show immediate revenue gains of £7 million for a campaign that includes TV vs one that doesn’t, and some £19 million incremental revenue over three years.

At The Kite Factory, we model client-by-client rather than at sector level but would broadly concur with Thinkbox’s findings. The more a retailer moves online, the more they need to spend on advertising. And if scale is the objective, then TV will almost inevitably be part of the media mix.

And for those outside the retail space wondering where this leaves you, our advice would be to book any pre-Christmas TV activity as soon as possible, to avoid any disappointment when it comes to your airtime plans.