This week, as we begin our second nationwide lockdown, we take a look at what the next few weeks potentially means for brands and the wider media market, and the possible silver linings to this very dark cloud.

Firstly, let us perform our own U-turn in regards to last week’s piece on retailers spending before Christmas as, sadly, this is now complete tosh. As of Thursday morning, all non-essential retail will be closed, for what would normally be their key run in weeks to Christmas. Black Friday (27 November) was forecast to deliver c.£6 billion in retail sales, up from £5.6 billion in 2019, with many of these sales taking place IRL, on the high street.

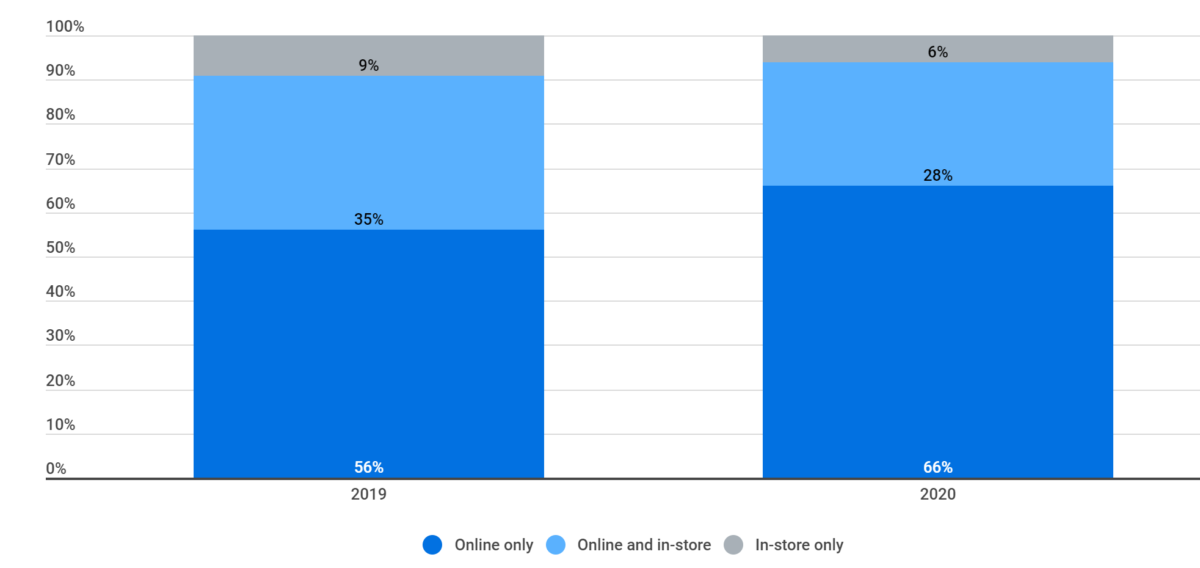

Springboard, the retail data company, reported that shopping centre footfall grew last Black Friday, up by 6.5% on 2018. The chart below shows survey results from Finder.com, who ran a quantitative study into claimed behaviour this Black Friday, with data from just last week. 39% of UK adults, or c18million of us planned to spend on offers over that weekend. 66% of buyers planned to make their purchases online, but that leaves 34% or some 6 million shoppers who will be thwarted by this lockdown.

Source: Finder.com

Source: Finder.com

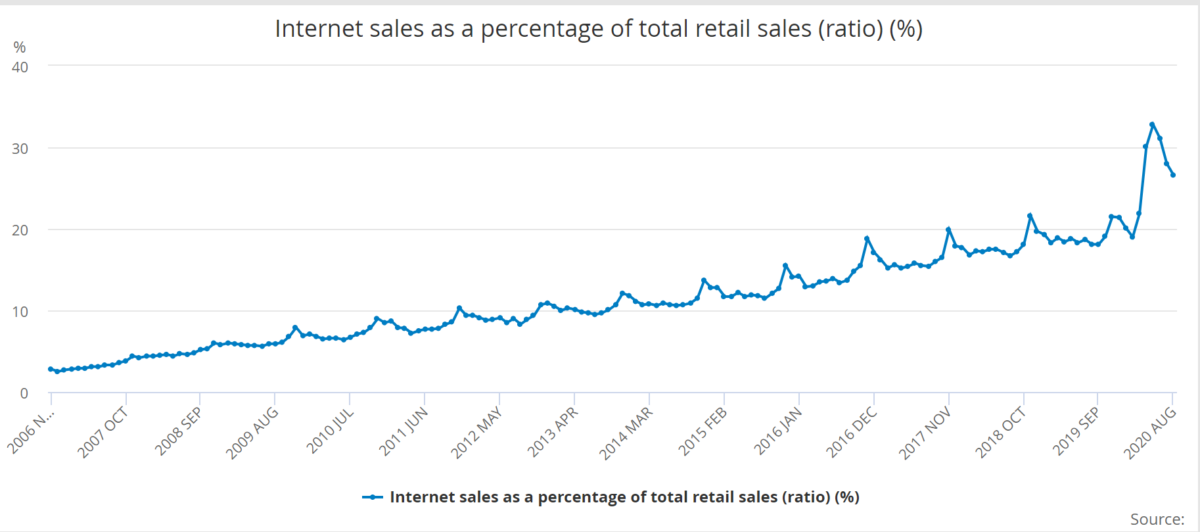

And this is where retailers will face a double-edged sword. They are damned if they don’t fulfil demand that switches from offline to online, and they may well be damned if they do. If the first lockdown taught us anything about online shopping, it taught us that creating demand is (relatively) easy. Supplying that demand is harder. Remember the lack of supermarket home delivery slots? And wine companies like Virgin wine closing their doors to new customers? If the data from Finder is correct, then there is potentially another 50% growth in online sales coming at the end of the month. If that happens, we expect to exceed the spike we saw in May, in the chart below, which shows internet sales as a % of total retail sales.

Source: ONS Internet sales as % of total retail sales 18th September 2020

If we see demand on Septembers base of 26% double then that means 40% of all retail sales go online which will undoubtedly break logistics and delivery systems. Sainsbury’s have just proudly announced that they have increased online sales capacity by 50%, and it’s taken them six months to do so. There will be a finite number of online orders that can be taken and fulfilled this Christmas.

All very interesting, but how is that relevant to me as a gym/ subscription media owner/ charity/ broadband service provider/ estate agent/ bank? Its relevant because it will change the shape of the media market this Christmas and may well offer you some opportunities to create demand for those of you who have services and products that are not supply constrained.

The first change we will see is yet another fall in demand for media space. Retailers spent c £360 million on media across November and December last year. Using the (admittedly imprecise but the best data available) Nielsen figures that represents c 15% of the total ad market in those eight weeks. Add in all those other things we are no longer allowed to do from Thursday (travel, gyms, hotels, entertainment, restaurants etc) and that comes to c £820 million or 1/3 of November and December ad spend. That’s one big hole.

Like all losses, these will not be evenly distributed. Some media will be left high and dry; commuter OOH and cinema impacts are once again on hold and non-subscription printed newspapers and magazines will continue to dwindle.

And others will flourish; we expect social media to do well however would council caution in adding too much of your own discretionary budget here. In spring, we saw Facebook feeds become crowded as SME retailers switched from high street to online sales – expect the same from today onwards. Finding innovative ways to cut through and reach your audience here, such as real-time creative versioning to maximise relevancy, will be increasingly important here.

Mail and door drops will almost certainly thrive. As we’re confined again to the barracks and a groundhog day routine, any new entrant to the house will be welcome. Readership levels jumped 45% during the last lockdown and we expect the same this time round. It’s also an easy way to gain share of attention and stand out from the digital din.

Radio will be neither here nor there. It lost audience in the last lockdown and we don’t expect major initiatives this time round.

The 800-pound gorilla in the room is TV. TV attracts more than 50% of retail spend at Christmas, and nearly 45% of ecommerce spend. We would expect audiences to soar again, and what retail (multi-channel) budgets there are to favour TV. BUT (and this is the final but), we expect a very different spend pattern this year.

Last year, retailers split their budgets 55% November / 45% December. This year, we expect what money there is to be disproportionately spent in November as the scarcity will be in delivery and logistics. If online retailers don’t get their orders and thus bookings of delivery capacity in early, they won’t get it at all. The competition will be for the November orders, because after that there may be demand, but probably not supply.

But what does all this mean for a non-retail client who is not supply constrained and can grow revenues from a stay at home audience who need a treat, a purpose or just distracting? Think of the December TV market as a potential once-in-a-decade opportunity – there will be audiences and media rates that you will not see again for a while and as of today, those audiences are still responding and still buying. We have seen clients take step changes in sales volumes these last six months and next month will allow them, and others, to do the same again. So, we can’t pretend it’s not a really black, crappy, rainy cloud, but there is at least this one little ray of silver lining on offer.