Radio has been on a roll for the last few years. Between 2015 and 2018 it managed to achieve what TV failed – growing its revenue year on year and holding share of total advertising spend at 3% (in the same period, TV lost £100million of revenue and 3.5% of share of spend). Radio’s high revenue point coincided with its triumphant launch of an ROI meta study in conjunction with Ebiquity, which claimed radio provided returns on media investment almost on parity with TV. Radio audiences remained steady over the same period, with commercial radio reaching 66% of UK adults, who listened for around 13 hours each week.

So far so good. But, unlike others, radio has not had a good lockdown. Regular readers of our updates will recall the simple threshold between the media channels that have thrived and those who have struggled these last six months, and it’s the threshold of your own front door. Media consumed in home (TV; social; mail; etc) have done well. Media consumed out of home (cinema; OOH; print newspapers) have not.

Radio is a habitual medium. We watch a wide repertoire of TV channels, choosing programmes over channels. We listen to a very narrow range of radio stations and chose stations over presenters and programmes. We are creatures of habit, listening to the same stations, in the same place day after day. The industry gold standard research (RAJAR) tells us that in Q1 2020, 24% of listening took place in our cars/vans/lorries; 16% took place at work; leaving just 60% of listening for the home. Unfortunately, that’s the last thing RAJAR tells us, having declined to release any data for Q2 2020.

So, determined to discover what happened to radio during and since lockdown, we looked at an excellent presentation from the IPA that took a very early look at 2020 Touchpoints data in field as we went into lockdown. This gave us pre-lockdown and during-lockdown media consumption and what we found on radio was a bit of a shocker.

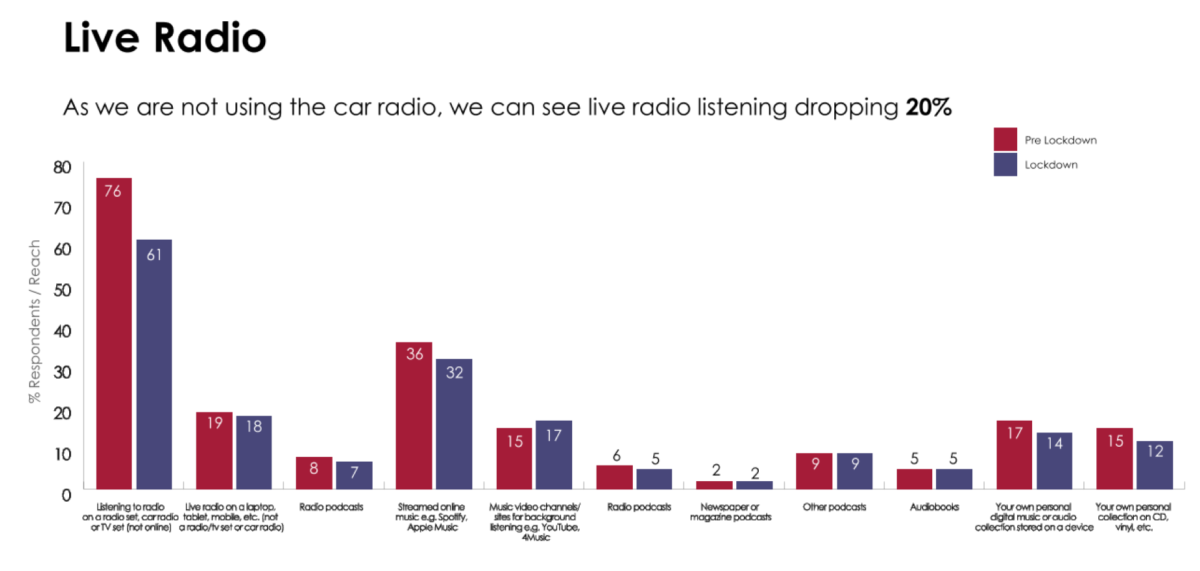

Source: IPA/IPSOS Life in lockdown webinar June 2020

The chart above shows the number of us listening to live radio, on any device, dropping by 20%, and on a radio set or car or TV by 15 points. Cross referencing this with YouGov data, we compared commercial radio listening in w/e 16 August 2020 with w/e 14 August 2019 and found a nearly 28% fall in weekly reach. So, two real-time, respected industry data sources, albeit not the approved JIC, telling us radio listening is down.

So, what does RAJAR have to say? Well they haven’t released Q2 data, but they have released findings from a newly created ‘Tracking panel’ and claim that “reach levels remain healthy, with reach in home up 11% and in vehicle down by 49% and at work down by 64%” – they decline to give a combined figure. Back of a fag packet weighting by us gives a c 16% decline in reach.

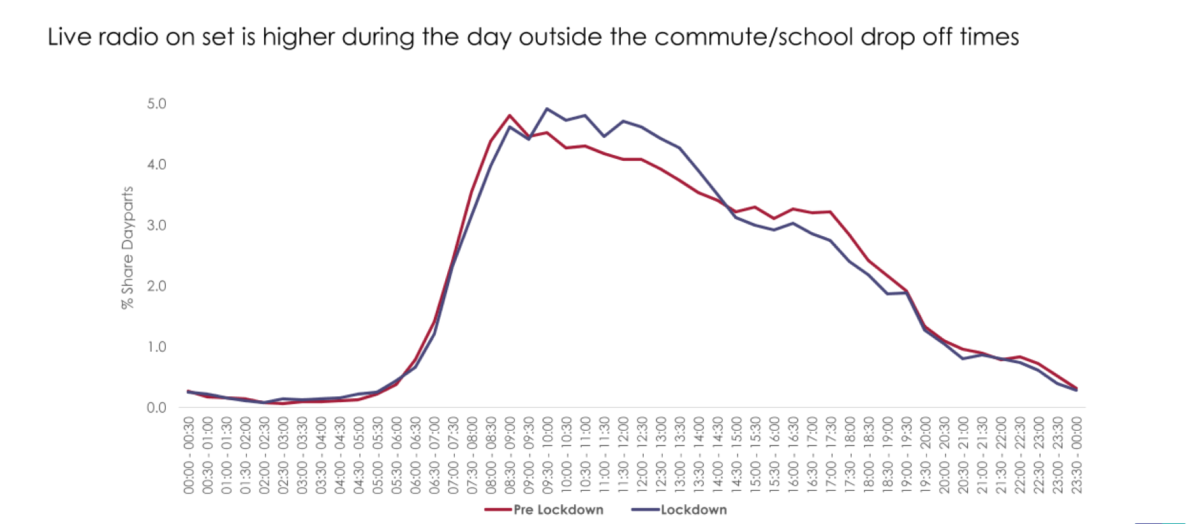

RAJAR also tell us that their morning peak declined, moving later to reflect the nation’s extra hour in bed during lockdown. YouGov agrees with this, reporting a 14% decline in weekday reach between 6am and 10am. What YouGov also tells us is that there is a similar, 15%, decline in reach in evening drive time. The IPA early Touchpoints report also supports this, showing share of media consumption for radio lower in traditional peak and higher in daytime.

Source: IPA/IPSOS Life in lockdown webinar June 2020

Why is this important? Because radio is a low reach, high frequency medium. That means in a standard campaign your ad can be heard lots, meaning that you will really annoy listeners unless you have several different ads or versions.

During lockdown, RAJAR tells us that of those who did listen, about a third listened to c.20% more hours per week. Taking this at face value it means that fewer people will hear your message, but those who do will hear many more, upping the potential irritation factor. So, in summary radio reaches fewer people, more often, and now needs more creative.

Radio has traditionally had several advantages that argued for its place on a schedule. It is cheaper in CPM terms than TV; creative production costs are lower; ads are normally quicker to produce than a TV commercial, and local radio stations allowed lower capital cost campaigns and real localisation of messages. However, these advantages are being eroded and as such, radio needs to beware.

TV was extremely discounted in lockdown and still offers the best value in years. Subsidised production and cloud production also meant TV ads could be produced and on-air in days. With the M&A activity in commercial radio, almost all local stations have not been rolled up into national groups, with national programming and, in most cases pan-regional sales.

We’re not saying that no radio station deserves a place on any schedule this autumn, nor yet that “Video killed the radio star”. Radio still has a place for very short lead time buys; it can be turned on and off more rapidly than TV in most cases; it offers excellent value for sponsorships; presenter mentions, and promotions provide creative flexibility. But looking to the future we might echo Scooby….