If Boris’s speech last night attracted the same level of interest as his lockdown announcement on 5th January then some 25 million of us will have watched him tell us that we will be released from all restrictions by the end of June. Or at least if all goes to plan, we will be. Because he has left himself a lot of wiggle room, both in what he said and what he did not say.

What he said was, at the earliest we will have:

- “Schools back and meet one other person for a coffee outside” from 8 March

- “Rule of six outside and end of legal lockdown” from 29 March

- “Outdoor pubs & restaurants; shops; hairdressers; gyms; libraries; self-catering UK holidays” from 12 April

- “Pubs indoors with rule of six; 30 people together outdoors; cinemas & sports venue with limited capacity” from 17 May

- “No limits on anything bar our four reviews” from 21 June

What he did not promise anything on were four quite big things:

- When social distancing and face masks can be dropped

- When international travel can restart

- What form a Vaccine passport will take

- When major events can resume

All of these are subject to reviews, the earliest of which will report on 12 April. As is often the case, what he didn’t say is likely to be as important, or more so, than what he did.

So, we have a political road map for the remainder of the year. But what are the implications for those looking to invest in media to create growth for our businesses? We share this note to add some signposts to Boris’s map, pointers as to where sunny uplands of growth might be found, and flags as to where valleys of despondency might lurk.

When: Think about a “Year of three seasons”

Perhaps the most useful way of thinking about what this means for us all for the remainder of the year is expressed by this image from Kantar- in which they suggest we face a year of three seasons.

Source: Kantar February 2021

Our spring, until the week before Easter, as per Boris, will be a continuation of lockdown. Our lives will be lived “In Home”- with expenditure, media consumption, and behaviours all rotating round an indoor, familial life. From mid-April onwards, as days lengthen, temperatures rise, and regulations relax we will return to socialisation, but outdoors and at a distance. Media consumption, behaviours, and spend patterns will change. In June there is the promise of the great unlock. True socialisation; back indoors; physical gatherings of more than six, and at a distance of less than six feet. For some it will be the mother of all parties.

But possibly only for some, because the thorny issues of “major events” and “vaccine passports” have been kicked into the long grass, alongside international travel. Our view as of today is that the real mass unlock will be closer to autumn than to June, driven partially by when the young get the impact of their first dose (end August), and when the government actually allow mass events (aka festivals and Cinderella Rockerfellas).

To conclude on when: Boris talked a good game today, but we expect the Kantar graphic above to be a reasonable working model for seasons in 2021.

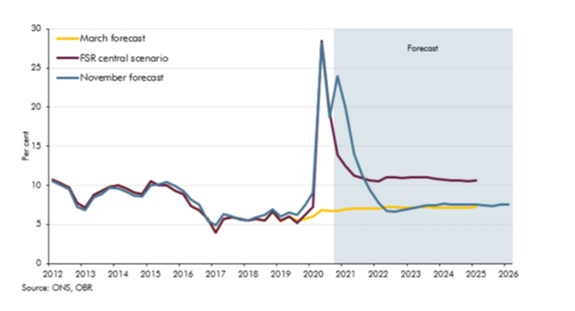

How much should I invest?: Go large

We agree with Andy Haldane – “the economy is poised like a coiled spring” to rebound into growth. Figure one, below, shows why. ONS measure, and the OBR report on, the amount of cash we have all saved during the last year. Not being out and not gadding about had led to us collectively building up a cash mountain of more than £100 billion by November last year. This lockdown has added another chunk to that pile- Haldane estimates it could reach £250 billion by July this year. That’s just under a fifth of the total annual UK consumer spending in 2019. We won’t spend it all, but even if we only spend half of it that’s the equivalent of another months’ worth of spending in the rest of this year.

Figure one: there was a savings cash mountain of more than £100 billion in November 2020

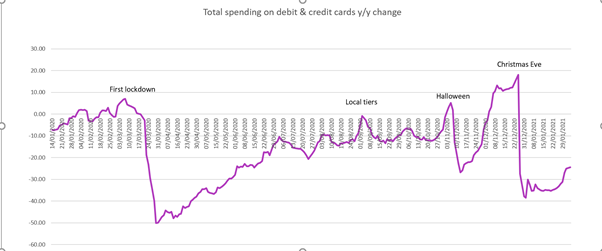

Will we spend it? Well, the evidence from Christmas is that we will. Figure two below uses one of the new “faster indicators” from ONS. Rather than wait six months or more to publish data on the economy as they used to, they now process and publish real time data (much as we do with your results!). This uses Chaps data (the people who process credit and debit card payments) to measure the year on year change in spending on cards (now more than 80% of our spending).

As we went into lockdown in March 2020 spending rose by about 10%- remember all those toilet rolls? It then dropped to half the levels of 2019 during the dark days of spring and early summer. But as we come to Halloween, and then to Christmas, it spikes up to between 10% and 20% growth on the already high levels seen in 2019.

Figure two: We are prepared to spend on treats and special events

Source: ONS/Chaps data February 18th 2021

We see this as evidence that we will spend big style on treats and special events- and if being able to socialise again isn’t a special event and cause for celebration, then what is?

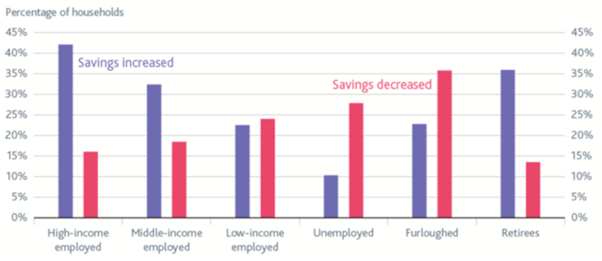

Who? The sad answer is not everybody

Yes, we have a whopping cash pile; yes, much of it will be spent; but not everyone has savings, and not all of those who have savings will spend them. So, who should be the focus of our investments- which audiences will have both the means and desire to buy more in 2021?

Figure three is a good starting point. It summarises research carried out by NMG consultants for the Bank of England in late 2020. Savings are concentrated amongst the retired and those better off and employed. The unemployed, those furloughed, and those earning less have seen their savings decrease in 2020.

Figure three: savings are not evenly distributed

Source: NMG/Bank of England 2020

The impact of furlough on the young can be seen in figure four below. As of early January, nearly 20% of the under 34’s were still furloughed, compared with 7% of the over 55’s. This group are (on the whole) desperate to get out and spend; to travel; to go to pubs, bars, restaurants, gyms and festivals and resume their lives. But more than 50% of them expect to struggle to pay their rent, mortgages and credit cards this year. They will be faced with stark choices in their discretionary spend allocations.

Figure four: more than half the under 34’s expect to struggle financially in 2021

As a footnote to this we shouldn’t forget the gender imbalance. Women are c 40% more likely to be furloughed than men as of January 2021. Here again the unemployment will hit hardest, curtailing spend. The ability to spend is not the only force that will impact actual consumer spending for the rest of this year. There is also the willingness to spend. Some 17 million of us are worried about our health; our finances; and the risk of losing our jobs. This group stretches across the life stages and is dominated by family and post family segments.

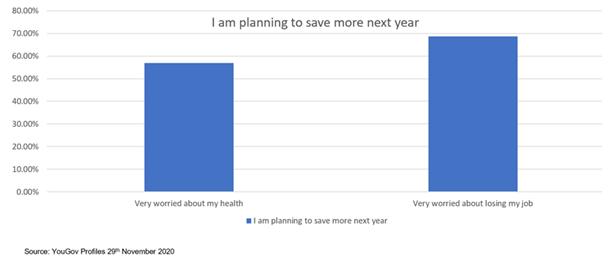

As can be seen from Figure 5 below, this fear will impact spending by those fearful, even if they have savings already. Nearly 60% of those who worry about their health are planning to save more in 2021. This rises to 68% of those worried about losing their jobs.

Figure five: a significant proportion of us plan to continue to save in 2021

The family groups are worried about both their health and losing their jobs. They remain worried about both these risks as of February. We can see the impact of the vaccine in the older groups, with those vaccinated already far less fearful about their health. Many of the post family are retired, and thus the employment issue does not arise.

Our conclusion on consumer spending in 2021 is that we agree with Andy Haldane, but with caveats. Our expectation is that all the young and old who can spend will spend. If one is targeting a family audience then checking attitudinal data to confirm willingness to spend by a specific audience in a specific category would be a wise move.

Which brings us to Where?: location

The population of the USA is far happier to relocate than us Brits. There is a culture in America of loading one’s home into a U Haul and driving the family to a new state to seek new opportunities. Those of us old enough to remember Norman Tebbit and his “get on your bike” advice of the 1980’s will know that the same population movement is less common in the UK. Well, perhaps until now. Three UK academics have coined the term “Zoomshock” to describe the likely movement of employment (and thus commercial opportunities) from cities as those who can, continue to work from home.

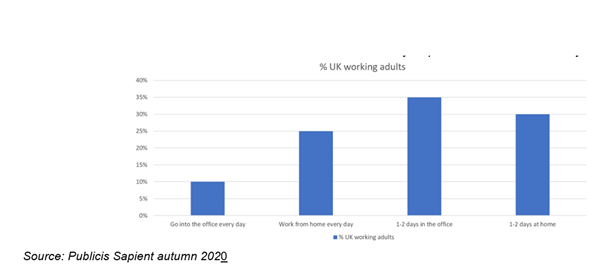

I am sure that the majority of readers will empathise with figure six, below. When asked if they would like to go back to the office, and if so for how many days, those currently working from home were emphatic in their response. Only 10% of us wish to go back to a daily commute; 65% are prepared to come in some of the time; and 25% of the anti-social wish to stay where they are!

Figure six: The majority of us working from home wish to continue to do so in 2021 (some of the time)

Clearly the impact of this will be felt on media channels such as OOH in transport and at hubs, and on “drive time “ radio. But there is an impact beyond the commute. Because this is all well and fine of if you have a choice to work at home. But not everyone does.

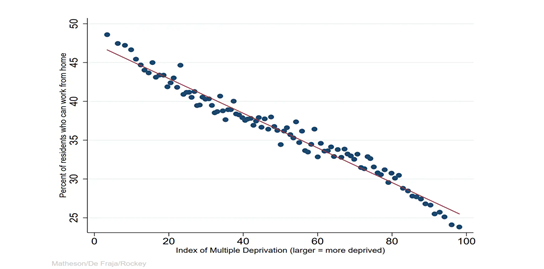

Just like the savings ratio the privilige of working from home is not evenly spread. In fact it is restricted to the privilged. Matheson, De Fraja and Rockey, the three academics refered to above, found that those who live ib areas of multiple deprivation (income, education, health, housing) are much less likely to be able to work from home. Figure seven, below, plots this for local authorities across the UK

Figure seven: The more privileged you are, the more likely you are to work from home

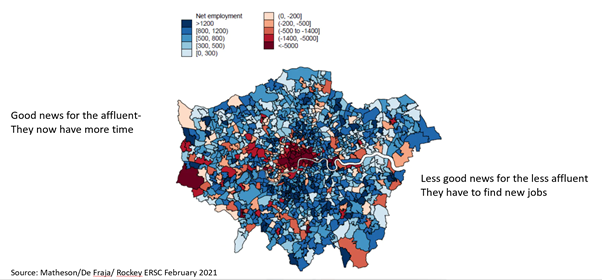

So, we have a population group (mostly you, dear readers) who can work from home. And will continue to do so. And a population group who cannot, some of whom were in service roles, supporting us when we were in the office. Many of those roles will cease to exist in the location they were found in in 2019. BUT they will be needed in a new location. If you live in Tooting and commuted to Oxford street and bought a coffee every day then that generated a job in Oxford street. If you now work from home in Tooting and buy your coffee there, then that creates a new job in Tooting. In a nutshell, that’s Zoomshock. Employment is moving from some areas to others. Mostly, as figure eight below shows, from city centres to the suburbs. Red areas are losing employment; blue areas gaining.

Figure eight: Zoomshock impact on employment London 2021

This pattern plays out across the whole of the UK. Mostly, but not always, with a migration of employment from urban centres to suburbs and beyond. There will be a population move to mirror this, which can already be seen in the falls in rental rates for flats in central London.

Implications for any geo located advertising, not just OOH, are significant. For door drops, display, social, mobile – it will pay to revisit the volumes of your potential audience in any catchment area. Just because counts have stayed stable for the last decade doesn’t mean they will be stable now.

What: What (or which) media channel(s) should we consider?

Three variables are at play here, with differing impact across the year. The first variable is the “year of three seasons”. As per Boris last night, until end of March we are all still confined to barracks. In home media consumption will continue to ride high, with anything that requires us to leave home limited in the impressions and reach they can deliver to advertisers.

Come May then we expect similar patterns to 2020- TV impacts to fall; OOH to rise; radio listening that has switched in home to fall; and events to become an opportunity again, in a socially distanced way. By October there will be more transport impressions; more city centre entertainment impressions; and maybe (3rd time lucky) the new Bond movie may even have been released and cinemas will have a measurable volume of impressions to sell.

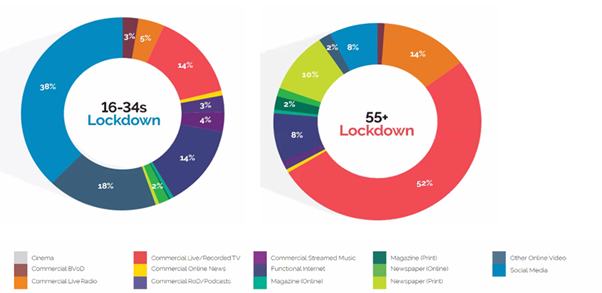

The second variable is the availability of audiences that have both the ability and the confidence to spend. The most desirable audiences in 2021 will be the old and the affluent. Jabbed, with savings, and with no fear of losing their jobs. Figures nine and ten below show they spend their media days with specific channels- and these channels differ from those their younger and less affluent counterparts chose.

Figure nine: the under 34’s spend their days on small screens; the over 55’s with large screens

Source: IPA Touchpoints 2021

The over 55’s spend more than 50% of their media day watching TV- whether live or recorded. Add radio and newspapers to this and three quarters of their day is taken up with “offline” media. The under 34’s are the polar opposite. More than 70% of their media day is dedicated to internet delivered media in the form of social networks, online video, streamed music/radio or functional internet.

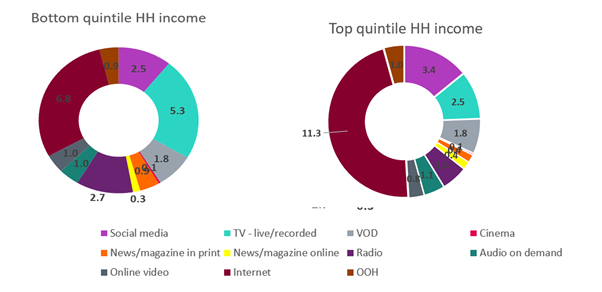

Similar variances are seen in the media consumption of the richer and poorer in society. Figure ten, below, shows how the top and bottom 20% of the UK by household income allocate their hours of media usage each day.

Figure ten: differences in income also drive disparate media consumption in 2021

Source: IPA Touchpoints 2021/ TKF analysis

In the case the more affluent audiences favour their smartphones, and with them the functional internet and social media. The less affluent spend twice as many hours watching TV and listening to radio. To target the older and richer audiences who have time, attitude and money, a combination of TV and digital channels will form the backbone of effective media investments in 2021. The final variable in answering the “what channel should I invest in” question is the behaviour of other advertisers.

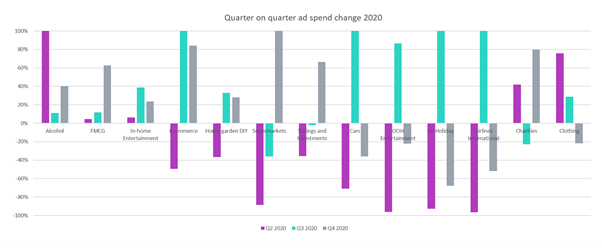

Figure eleven, below illustrates this. With the exception of travel and retail, which have seasonal demand drivers, most industry sectors have historically invested on a reasonably predictable basis across the year. Swings of 20%-30% in demand by quarter are typical. This was not the case in 2020. With the exception of “in home” consumption sectors such as alcohol, FMCG, and in-home entertainment (e.g. Disney+), all other client categories saw huge and sudden changes in spends quarter on quarter. Falls of between 50% and 90% were common in Q2, flowed by increases of 600% and up to 2000% in subsequent quarters.

Figure eleven: 2020 saw wild swings in advertiser sector investment by quarter

Source: Nielsen AdIntel/ TKF analysis

We have never seen a more volatile and unstable media marketplace. In order to maximise the value that is to be gained in the market this year we would remind readers of the dictum “No plan survives contact with the enemy”. Build an investment strategy for the remainder of this year, using the drivers described in this note as signposts. Then be prepared to flex that strategy to take advantage of the tactical opportunities that the market will afford- often arising on a weekly or even daily basis.

Three actions you can take that will drive effectiveness and net revenue growth in 2021

- Go focussed but Go big.

Audiences who have money to spend and the desire to spend it will be prepared to change their behaviours and loyalties to release the frustrations of the artificial constraints imposed upon them. You may have to argue your case with your CFO to invest in media this year, but correctly deployed it will give you an advantage against competitors who cannot or will not be able to do so.

- Reflect and amplify the unique seasonal pattern of 2021

We see a year of three seasons.

- Indoors and virtual until April

- Outdoors and social from April until August

- Returning indoors and to mass collective entertainment from September

What to do about the first of these is easy – more of the same that we all learned how to execute in April 2020 and have sustained in waves ever since.

The second is a more nuanced challenge. Our big bet is that there will be very little overseas travel this summer. Matt Hancock’s motivation is clear- reduce risk from variants. Rishi Sunak also has much to gain. He needs to find a way to pay down the debt incurred in the last year. A 1p rise in income tax would raise c£6 billion a year. Persuading us not to go abroad on holiday would push the £43.4 billion we spent on foreign travel in 2019 into the UK economy. It would also mean that some 40 million of us will be here seeking socialisation, relaxation and entertainment for the two weeks we would have been away.

Brands that can take advantage of, or better yet facilitate, the creation of new, safe, socially distanced real-life events will gain attention, engagement and appreciation from audiences looking for substitutes to trips they cannot or will not make.

The third season will be dominated by one thing – Christmas. This will be the opportunity for the family gatherings and celebrations with friends. It was the one time in 2020 when we spent significantly more on our cards, and that’s when we weren’t supposed to be with others. Everyone, no matter what their circumstances, will want to make this the best Christmas ever. We strongly recommend planning (and if possible, booking) Christmas campaigns before Easter. Some media, like the favourite toys) will sell out this year. This thinking will also apply to travel advertisers from Boxing day on.

- Have a strategy, but be prepared for tactical change

Plan for change, and then plan for more change. At a strategic level we can plan to change the audiences we target; the geo-locations we chose to advertise in; the phasing and timing of investments; and the media channels and opportunities we will partner with. But as Mike Tyson said, “everyone has a plan until they are punched in the face”.

Expect both constituents of your Costs per Response equation to change on a daily basis this year and you will not be disappointed. Media costs and availability have risen and fallen by up to ten times their usual volatility in 2020. Consumer response to DTC messages have shown similar swings. The weekend the pubs (finally open) don’t expect anyone to buy anything but beer and the odd scotch egg. Joking apart, be prepared to take advantage either of rock bottom media rates, or of soaring response rates, at what may be hours’ notice. Equally don’t be afraid of pausing investment if there is a movement in the force.

The last eleven months have shown that the brightest, best, and boldest marketers can continue to grow both their top and bottom-line revenues, even when facing the challenges of change on multiple fronts. 2021 will continue to throw change and challenges at all of us, but we offer these signposts as navigational support for Boris’s roadmap to recovery. Please ask us if you would like a personal voice over to accompany the satnav we offer here.