Reach, (formerly known as Trinity Mirror), publisher of The Mirror, Express, Star and some 240 regional press titles caught my eye this morning. They announced that they are paying shareholders a dividend based on the 2020 performance. Not only a dividend, but an increased dividend, for the first time since 2007. This clashed so significantly with my world view that I decided to ask why?

The answers are both topical and hold potential for performance advertisers seeking to reallocate programmatic display and video investments. These investments now being less effective thanks to the impact of iOS 14 (see our Director of Digital’s view on the latest iOS update for more). They point us at a digital investment strategy that protects consumer interests; protects the revenues that content creators receive; and restores the importance of context to our digital advertising placements. And most importantly promises to generate improved effectiveness for advertisers.

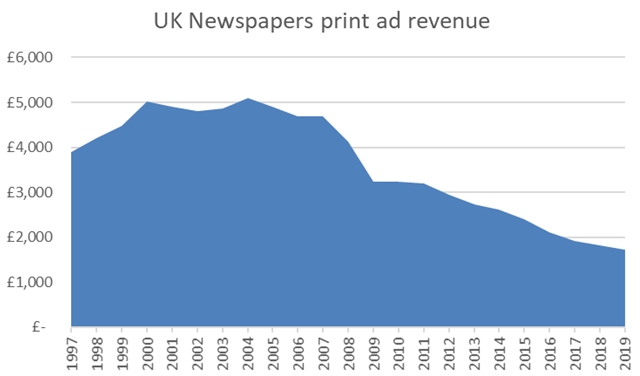

The reason for my shock in reading the dividend announcement can be seen in figures one and two below. Over the last decade, advertising revenues from print editions of UK newspapers have declined by more than £3 billion.

Figure One: Print advertising revenue for UK newspapers has declined by £3bn in less than a decade

Source: AA/WARC

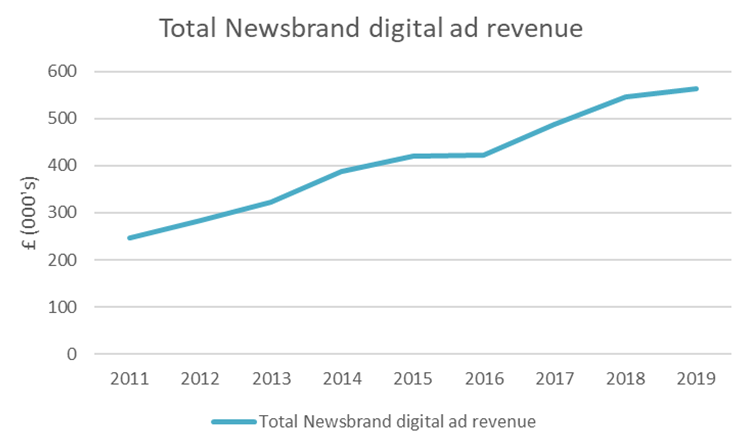

During the same period, digital advertising revenues have replaced less than one-sixth of this loss.

Figure two below shows total Newsbrand digital advertising revenue, reaching just £564 million in 2019, growing by just 3% over 2018.

Figure two: Digital revenue growth made up just 1/6th of print revenues lost

Source: AA/WARC

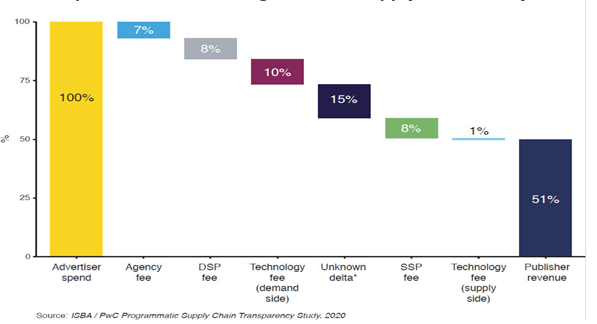

One reason for this small level of growth can be seen in figure three below.

Back in May 2020, ISBA published their programmatic supply chain study. This measured where each pound their member spent on programmatic digital media (essentially online video and display) ended up. Their key finding was that only 51 pence in each pound went to the media owner.

Figure three: ISBA found that media owners received only 51% of gross programmatic ad spend

For Reach, this challenge was compounded by their strength and weakness. Their unique strength is the sheer number of UK adults who read or view one of their sites each month. But this strength benefits their competitors (and especially Facebook) more than themselves.

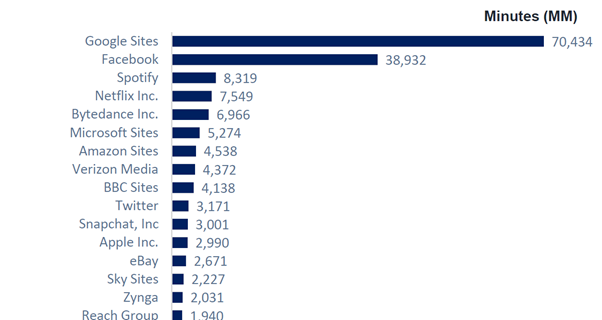

Figure Four: Reach properties deliver 41.4 million unique visitors per month

Source: UKOM Digital market overview Q3 2020

The combination of national and local newspaper sites that Reach own are read or viewed by 91% of the UK population in a typical month. They are the fourth largest digital media owner in the UK, closely behind Amazon, Facebook and Google.

Unfortunately, their spectacular number of visitors each month have little loyalty. Between them, the 41.5 million unique visitors deliver only 1,940 million minutes of screen time to Reach in a month. That’s 3% of the time Google attracts and only 5% of the time spent with Facebook. Their weakness is that their “readers” can be found, via the power of third-party cookies, on other sites, and often at lower media CPM’s than Reach can offer.

Figure five: They haven’t kept those visitors staying with them or coming back every day

Source: UKOM Digital market overview Q3 2020

So, Reach has fewer ad impressions to sell; and end up with only 51% of the smaller pot. Not a great starting point from which to reinvent a business. Which brings me to my question of this morning – why would Jim Mullen, the Reach CEO, have the confidence to reinstate the dividend and increase it?

The answer comes in the form of a change in market forces and his strategic reaction to them.

Historically media owners sold their offline inventory directly to advertisers via agencies. If you wanted to buy a Daily Mirror reader, then you had to place a page in the Daily Mirror. In the new online world of third-party data, a Mirror reader could be bought on a Daily Mirror site, or minutes later, at a cheaper price, elsewhere. We knew who they were; valued them because they are a Daily Mirror reader; and then bought them from the lowest priced media owner.

With the advent of iOS14, it is becoming increasingly difficult to know that the impression you buy from Facebook is actually a Daily Mirror reader. (Cookie pools are currently 40% lower than in 2019, and we expect them to fall to between 10% & 20% of 2019 levels by 2022). So, if Mirror readers are an important audience then we have to go back to the Mirror, as we used to a decade or two back. That’s the market forces change that is benefiting Reach.

Strategic investments are enabling them to take full advantage of this opportunity. They have identified the power that first-party data presents on Google and Facebook and are matching them.

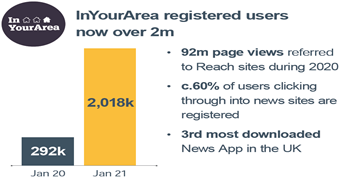

They have now persuaded five million readers, or more than 10% of their audience to register with them. By growing their own directly generated traffic, there is less reliance on Google and Facebook. In the last 12 months, they have grown the number of registered users of InYourArea, a local news app, from 300,000 to more than 2,000,000.

Figure six: InYourArea – an investment strategy to provide first-party data and direct traffic to Reach sites

Source: Reach FY 2020 Preliminary results Investors presentation

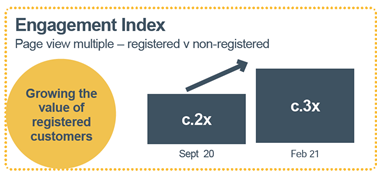

The first win Reach have seen from this strategy is that they are generating more page views per reader. Registered readers, as of this month, stay 3 times longer and read 3 times the number of pages that nonregistered readers do. Remember the gap in figure five – lots of readers but not many minutes spent. This strategy is on the way to fixing that problem.

Figure seven: Those registered users stay longer and read more pages

Source: Reach FY 2020 Preliminary results Investors presentation

This has helped Reach grow total page views by 30% YoY in December 2020- more ad impressions to sell. Ad impressions that we would have bought from their two biggest competitors.

The last advantage that investment in first-party data brings is the ability to sell the advertising for higher prices. Crudely speaking most advertisers measure success in costs per sale terms. They have a fixed margin they can afford to pay for each sale they make. Media buying strategies focus on driving the cost of media down, or the response up. The more you know about your audience the better decisions you can make as an advertiser, and the greater the value of that audience to a media owner. This first party data play lets Reach take Google and Facebook on toe to toe.

Registration, and the permissions that come with it, enable Reach to track audience behaviour. They can create bespoke segments for advertisers, and deliver real time reach and frequency and interaction data for each segment to the client and agency. This also allows matching of client first-party data with media owner first-party data (think custom audiences) and the development of hyper local datasets-restoring the unique power that local press used to enjoy. In a post Covid world where local the community will continue to be important in all our lives, this could be a powerful advantage. Early tests are showing between 10% and 40% uplift for clients.

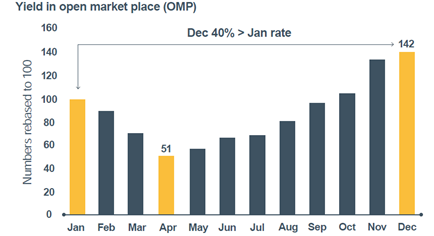

The proof in all these things was in Jerry Maguire “show me the money”. Well, it is early days as yet, but buried in the middle of today’s Reach 2020 preliminary results is the chart shown as figure eight below. Across the last twelve months, in a turbulent 2020, they have managed to increase the yield (that’s pound for each eyeball they deliver) by 40%. They either sold 40% more of their eyeballs or sold them for 40% more in December when compared with January. Now that’s not a strictly fair comparison – Christmas has more advertiser demand (especially in 2020) than January. But it’s a good straw in the wind.

Figure eight: First-party data will help increase the price Reach can command for programmatic advertising

Why would this be of interest and what might all this mean for readers today?

One of the biggest challenges to the effectiveness of digital video and display during the next year will be the impact of iOS14 and Googles move on third party data. There will be no single silver bullet solution to this challenge, but a major plank in the mitigation will be to maximise the value of first-party data.

This note shows the value of first-party data to one media owner. We would hope that it inspires clients to equally invest in their first-party data with similar returns in mind.

We also see the rising importance of “old fashioned” media owners like Reach, coming late to the digital party. We see them bringing new and unique opportunities to access audiences to create growth for clients. Early partners will benefit from learning ahead of the market, and from grandfathered media rates.

To discuss more on this, and other strategies to improve the effectiveness of your digital display and video, please get in touch.